Real estate has long been a preferred path to wealth, but with “Money6x Real Estate,” there’s a fresh, transformative approach for individuals aiming to build financial freedom. This guide delves into the exciting world of Money6x Real Estate, providing expert insight, practical tips, and a roadmap for making wise investment choices. Whether you’re a newbie or a seasoned investor, this article will clarify the potential of Money6x Real Estate and how you can make it work for your financial goals.

What Is Money6x Real Estate?

Money6x Real Estate is an investment approach focusing on maximizing wealth through six core principles—hence the name “6x.” This method aims to accelerate financial gains by leveraging property investment strategies that optimize returns while minimizing risk. The Money6x Real Estate model emphasizes property diversification, effective management, and strategic buying, making it suitable for various investor types.

Key Pillars of Money6x Real Estate

Money6x Real Estate revolves around these main principles:

- Diversification: Spread investments across different types of properties.

- Market Timing: Buy when the market favors buyers and sell when prices peak.

- Efficient Management: Reduce operating costs to boost profits.

- Financial Leverage: Use mortgages or loans to increase buying power.

- Risk Management: Protect your investments through insurance and prudent decision-making.

- Smart Selling: Exit strategies that maximize value.

Why Money6x Real Estate Is a Game-Changer

Unlike traditional real estate investment, Money6x Real Estate provides a structured, step-by-step approach that helps investors avoid common pitfalls. By following these principles, individuals can enjoy more stable returns, secure financing options, and establish a steady stream of income. This model empowers both beginners and experts by teaching them how to identify lucrative opportunities and understand the market dynamics.

The Benefits of Investing in Money6x Real Estate

There are numerous advantages to this investment model. Here’s a closer look:

- Steady Cash Flow: With the right properties, you can enjoy monthly rental income.

- Appreciation Potential: Real estate typically increases in value over time, creating wealth.

- Tax Advantages: Depreciation, mortgage interest deductions, and other benefits lower tax liability.

- Leverage and Scaling: Borrowing allows you to purchase higher-value properties, scaling your investments.

- Wealth Preservation: Real estate often withstands inflation and market fluctuations, protecting your assets.

How to Get Started with Money6x Real Estate

Starting with Money6x Real Estate requires careful planning, a bit of patience, and a good understanding of your financial goals. Here’s a step-by-step approach to help you embark on this journey.

Step 1: Set Clear Financial Goals

Determine what you want to achieve. Are you looking for passive income, long-term wealth, or both? Your goals will shape the type of properties you invest in and how you manage them.

Step 2: Educate Yourself About the Market

Understanding the real estate market is crucial. Familiarize yourself with current trends, property values, and rental rates in the areas you’re interested in. Research how Money6x Real Estate fits into various property types like:

- Residential Properties: Single-family homes, condos, townhouses.

- Commercial Real Estate: Office spaces, retail stores, and industrial properties.

- Multi-Family Units: Apartment buildings, duplexes, or triplexes that generate rental income.

Step 3: Assess Your Financing Options

Money6x Real Estate often involves leveraging loans to buy properties. Consider mortgages, personal loans, or even partnerships. The right financing increases purchasing power without depleting your savings.

Step 4: Start Small and Scale

It’s wise to begin with a smaller investment property to learn the ropes before taking on larger projects. For example, a single-family rental property is easier to manage than a commercial complex. As you gain experience, gradually expand your portfolio to achieve Money6x Real Estate goals.

Exploring Different Types of Money6x Real Estate Properties

The Money6x Real Estate model can be applied to various property types. Here’s a breakdown of the most common ones and how each can help maximize returns.

| Property Type | Description | Investment Potential |

|---|---|---|

| Single-Family Homes | Ideal for beginners; lower maintenance | Steady cash flow and appreciation potential |

| Multi-Family Units | Multiple tenants; higher rental income | Scalability and strong passive income |

| Commercial Spaces | Retail, office, or industrial properties | High returns, but requires experience |

| Vacation Rentals | Short-term stays, often in tourist areas | Seasonal income, tax benefits |

| Mixed-Use Properties | Combines residential and commercial spaces | Balanced income sources and property value growth |

Money6x Real Estate encourages investors to diversify across multiple property types to maximize income and reduce risk.

Key Strategies to Maximize Your Money6x Real Estate Investment

To thrive in Money6x Real Estate, apply these essential strategies:

Buy and Hold for Long-Term Appreciation

In this strategy, you purchase a property and hold onto it while its value appreciates. Over time, you may also gain from rental income. Money6x Real Estate experts recommend this approach as it builds equity while keeping options open for future resale.

House Flipping for Quick Profits

House flipping involves buying, renovating, and selling properties at a profit. This strategy requires thorough knowledge of the local market and renovation costs but can yield high returns if executed well.

Rental Properties for Passive Income

Investing in rental properties creates a steady stream of passive income. By choosing a prime location and keeping units in good shape, you can attract high-quality tenants and enjoy a reliable cash flow.

REITs: Real Estate Investment Trusts

For those who want to invest without the responsibilities of property management, REITs offer a practical solution. These trusts pool money to invest in real estate, providing dividends to shareholders. Money6x Real Estate recommends REITs as a way to diversify and mitigate risk.

Common Mistakes to Avoid in Money6x Real Estate

Even seasoned investors make mistakes. Here are some pitfalls to avoid when following the Money6x Real Estate approach:

- Ignoring Market Research: Make informed decisions by understanding the property’s potential and the area’s trends.

- Overleveraging: Borrowing too much can backfire if the property doesn’t generate expected returns.

- Neglecting Maintenance Costs: Unexpected repairs can eat into profits. Budget for maintenance from the start.

- Underestimating Tenant Screening: Problematic tenants can disrupt cash flow and cause property damage.

- Skipping Professional Help: Work with real estate agents, financial advisors, and attorneys when necessary.

Money6x Real Estate emphasizes strategic planning and professional guidance to avoid these pitfalls.

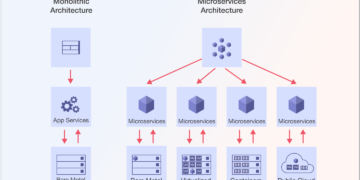

The Role of Technology in Money6x Real Estate

In the digital age, technology has transformed real estate. Money6x Real Estate encourages investors to use tools and platforms that streamline property management, market research, and financing.

Useful Tools and Apps for Investors

- Property Management Software: Tools like Buildium or Appfolio help manage tenant relations, rental payments, and maintenance.

- Investment Calculators: Online calculators estimate costs, potential income, and ROI.

- Real Estate Market Apps: Zillow, Redfin, and Realtor.com offer valuable insights on property listings and trends.

Using these resources saves time and reduces errors, making your Money6x Real Estate investment journey smoother.

How to Manage Money6x Real Estate Properties for Maximum Returns

Efficient property management is key to maximizing returns. Here are some tips to ensure your properties remain profitable:

- Prioritize Tenant Satisfaction: Happy tenants stay longer and take care of the property.

- Keep Maintenance Up-to-Date: Regular inspections prevent costly repairs.

- Optimize Rent Prices: Set competitive rents based on market research.

- Minimize Vacancy Periods: A good marketing strategy reduces vacant periods.

By following these tips, investors align with Money6x Real Estate principles and maintain profitable, well-managed properties.

The Future of Money6x Real Estate

With evolving trends in urban development, sustainability, and digital transformation, Money6x Real Estate is primed to adapt and grow. Experts predict a rise in demand for eco-friendly and tech-integrated properties, making them a solid investment for the future.

Preparing for Tomorrow’s Market

- Invest in Green Properties: Energy-efficient buildings attract tenants and reduce operational costs.

- Embrace Smart Home Tech: Homes with automated features are increasingly popular.

- Explore New Locations: Growing areas offer affordable prices with high appreciation potential.

Money6x Real Estate offers a future-proof investment model that encourages adaptability and innovation.

Conclusion: Why Money6x Real Estate Is Your Path to Wealth

Money6x Real Estate provides a structured, strategic pathway to financial independence. By focusing on diversification, market knowledge, efficient management, and prudent financial choices, investors can enjoy stable income and long-term growth. If you’re ready to embark on this journey, take the first step by setting clear goals and educating yourself about the market. Money6x Real Estate isn’t just an investment model; it’s a lifestyle choice for those who envision a financially secure future.