An itemized bill is more than just a simple invoice; it’s a detailed breakdown of all the charges incurred during a transaction. Whether you’re dining at a restaurant, receiving a medical service, or paying for a home renovation, an itemized bill provides transparency and clarity on what you’re being charged for. This article explores what an itemized bill is, its importance, and how it can benefit both consumers and businesses.

What is an Itemized Bill?

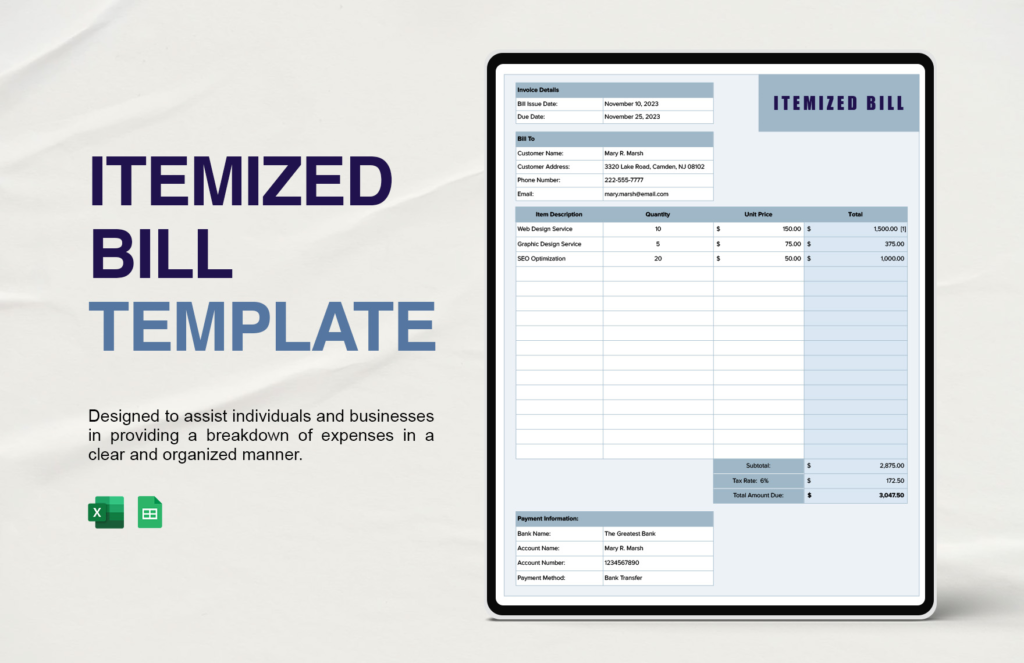

An itemized bill is a document that lists each product or service that was purchased along with its corresponding price. It provides a detailed breakdown of costs, taxes, and any other charges. Unlike a generic bill or receipt, which might only show the total amount due, an itemized bill breaks down individual costs, showing how the final amount was calculated.

For example, a restaurant itemized bill would list the appetizers, main course, drinks, taxes, tips, and any other charges separately. In medical or repair services, it would outline each procedure, part, or service rendered with its respective cost.

The Importance of an Itemized Bill

Transparency and Clarity

An itemized bill provides complete transparency. Without it, customers might feel unsure about how the total price is determined, especially when unexpected charges appear. It offers clarity and reassurance that the price reflects only the services or products that were used.

Helps Resolve Disputes

Itemized bills are essential when there are discrepancies between the service provider and the customer. If a consumer believes they’ve been overcharged or billed for something they didn’t receive, an itemized bill can serve as clear proof. It also makes it easier for businesses to defend their charges in case of disputes.

Budgeting and Financial Planning

For individuals or businesses managing a budget, an itemized bill helps break down the costs of specific items. Instead of seeing a lump sum, you can identify areas where money was spent and make adjustments in future budgets. For example, a household might review their monthly utility itemized bill to determine if there are unnecessary expenses that could be cut down.

Tax and Insurance Purposes

Many businesses and individuals use itemized bills for tax purposes. They can serve as evidence of expenses that need to be documented for tax deductions. For instance, medical professionals often issue itemized bills for their patients so that they can submit them to insurance companies for reimbursement or tax reporting.

How to Read and Understand an Itemized Bill

An itemized bill can sometimes seem overwhelming due to the level of detail it contains. However, understanding how to read it can help you make informed financial decisions.

- Check for a Detailed Breakdown: Ensure that the bill lists all the products and services separately. For example, in a hotel, you may see a breakdown that includes room charges, service fees, taxes, and amenities.

- Look for Discounts or Special Offers: Sometimes, businesses offer discounts, promotional codes, or coupons that are reflected in an itemized bill. These will typically appear as deductions from individual line items.

- Verify Accuracy: Compare the listed items to what you received. If you were charged for something you didn’t receive or notice an error, this is your opportunity to bring it up for clarification or correction.

- Review Taxes and Fees: Taxes are typically listed at the bottom of an itemized bill. Be sure to verify that the tax rate applied matches the local sales tax rate or applicable tax regulations.

- Understand Additional Fees: Some businesses might add additional fees, such as service charges or delivery charges, that are not immediately obvious. Ensure that any fees applied are explained and justified.

Common Examples of Itemized Bills

Restaurant Itemized Bill

When dining at a restaurant, an itemized bill will typically include:

- Appetizers, Main Course, Desserts: These are the food items you’ve ordered.

- Drinks: Whether alcoholic or non-alcoholic, drinks will be listed individually.

- Service Charges or Tips: In some regions or restaurants, a service charge may be added automatically to the bill.

- Tax and Gratuity: Sales tax and gratuity are clearly listed.

An itemized bill in a restaurant ensures that each component of the meal is shown separately so you can track what you are paying for.

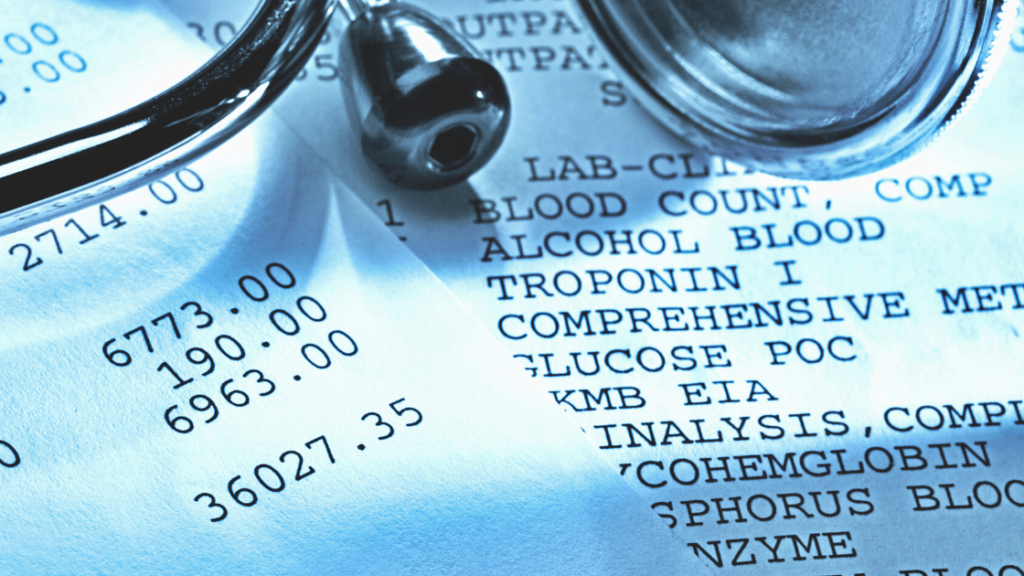

Medical Itemized Bill

Medical itemized bills include:

- Consultation or Procedure Fees: Charges for doctor visits, medical tests, and any specific procedures.

- Medications and Treatments: Charges for prescribed drugs, medical equipment, or treatments received.

- Insurance Adjustments or Payments: The portion of the bill covered by insurance, along with what remains for the patient to pay.

Understanding the medical itemized bill is crucial in making sure that your insurance company has covered the agreed-upon services and that you’re not paying for anything that wasn’t provided.

Home Improvement or Repair Itemized Bill

When hiring a contractor for home improvement or repairs, an itemized bill might look like this:

- Labor Costs: This includes the hours worked by the contractor and their team.

- Materials Used: Charges for building materials, supplies, or special equipment used during the project.

- Permit or Inspection Fees: If permits were required for the project, these would be listed.

- Travel or Delivery Charges: Any charges related to transporting materials or traveling to the job site.

An itemized bill for home repairs ensures that you understand exactly what work was done and the specific costs involved.

How an Itemized Bill Benefits Businesses

While itemized bills primarily benefit consumers, they also help businesses in several ways:

- Improved Customer Trust: Providing a transparent, itemized bill can enhance customer satisfaction and trust. When customers see the breakdown of costs, they feel more confident in the business.

- Minimized Disputes: By offering a detailed explanation of charges, businesses reduce the likelihood of complaints and disputes. Customers are less likely to question charges when they see how the total was calculated.

- Financial Management: Itemized bills can help businesses keep better records of expenses and income, ensuring accurate bookkeeping and efficient tax reporting.

- Better Service Customization: Businesses can analyze the itemized bills over time to determine which services or products are most popular or profitable. This data can help them adjust their offerings or pricing strategies accordingly.

Conclusion: The Value of an Itemized Bill

An itemized bill is more than just a piece of paper that shows how much you owe. It is a detailed breakdown that provides transparency, fosters trust, and ensures that both consumers and businesses are on the same page regarding costs. Whether you are reviewing a restaurant receipt, a medical bill, or a home improvement invoice, understanding how to read and interpret an itemized bill is essential.

By offering clear insight into the specifics of charges, an itemized bill can also help resolve disputes, assist with budgeting, and ensure accurate tax filings. As both a consumer and a business owner, embracing the benefits of an itemized bill is crucial for maintaining financial transparency and accountability.