In today’s fast-paced world, technology is reshaping the way we think about money. One exciting development in this realm is luxury fintechzoom, a term that encapsulates the integration of financial technology into the high-end lifestyle sector. This article aims to delve into the concept of luxury fintechzoom, its benefits, key players, and how it’s transforming personal finance and investments for the affluent.

What is Luxury FintechZoom?

Luxury fintechzoom represents the convergence of luxury living and advanced financial technology. It involves digital solutions that cater specifically to the needs and preferences of wealthy individuals, enhancing their financial management and investment experiences. This niche segment of fintech not only focuses on making transactions easier but also on providing a seamless and luxurious experience.

Characteristics of Luxury FintechZoom

- Tailored Solutions: Services are customized to meet the unique needs of high-net-worth individuals (HNWIs).

- Personalized Service: High-touch customer service is a hallmark, often including dedicated advisors or concierge services.

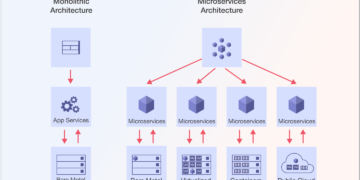

- Innovative Technology: The use of cutting-edge technology, such as artificial intelligence and blockchain, to enhance security and efficiency.

- Exclusive Access: Many luxury fintech services offer exclusive investment opportunities that are not available to the average investor.

The Evolution of Fintech and Luxury Markets

The financial technology industry has seen tremendous growth over the past decade. From mobile banking apps to investment platforms, fintech has made financial services more accessible to the masses. However, the luxury market requires a different approach.

Historical Context

- Early Innovations: The rise of online banking in the early 2000s began to pave the way for digital financial services.

- Wealth Management Revolution: Traditional wealth management firms started incorporating technology to enhance client experiences.

- Emergence of Luxury Fintech: In the late 2010s, the need for luxury-focused fintech solutions became apparent as HNWIs sought personalized services that matched their lifestyles.

Benefits of Luxury FintechZoom

The emergence of luxury fintechzoom has brought numerous advantages to affluent clients. Understanding these benefits can help individuals make informed decisions about their financial management.

Streamlined Financial Management

Luxury fintech services often offer integrated platforms where clients can manage all their financial assets in one place. This includes:

- Real-time Tracking: Monitor investments, expenses, and income from a single dashboard.

- Automated Alerts: Get notifications for important financial events, ensuring nothing goes unnoticed.

- Holistic View: Access to a comprehensive view of personal and investment portfolios.

Enhanced Security Features

Wealthy individuals are often targets for fraud and cyberattacks. Luxury fintech solutions prioritize security by offering:

- Advanced Encryption: Protect sensitive financial data from unauthorized access.

- Multi-Factor Authentication: Ensure that only authorized users can access financial accounts.

- Regular Security Audits: Frequent assessments to identify and rectify vulnerabilities.

Personalized Investment Opportunities

With luxury fintechzoom, clients gain access to unique investment avenues that cater to their interests and risk appetites:

- Exclusive Deals: Opportunities in luxury real estate, art investments, and private equity.

- Customized Portfolio Management: Investment strategies tailored to individual financial goals and market trends.

Key Players in Luxury FintechZoom

As the luxury fintech market grows, several companies stand out as leaders in providing innovative solutions tailored to HNWIs.

Notable Companies

- Wealthfront: Offers personalized investment management and financial planning tools designed for affluent clients.

- Robinhood Gold: A premium version of the popular trading app, providing advanced features and higher investing limits.

- Kavout: Uses machine learning to provide investment insights, appealing to tech-savvy investors in the luxury market.

Emerging Startups

- Aspiration: Focuses on socially responsible investing while providing traditional banking services.

- N26: A digital bank that emphasizes transparency and offers luxury services like travel insurance and premium accounts.

How Luxury FintechZoom is Changing Wealth Management

The rise of luxury fintechzoom is revolutionizing how wealth management is approached. Clients are no longer satisfied with traditional models and are seeking more innovative, tech-driven solutions.

The Shift Toward Technology

- Data-Driven Decisions: Wealth managers now use advanced analytics to guide investment strategies.

- Client Engagement: Digital platforms allow for greater interaction and transparency between advisors and clients.

- Global Access: Wealth management services are now available worldwide, breaking down geographical barriers.

The Role of Personalization

Personalization has become a key factor in wealth management. Clients want services that resonate with their unique values and lifestyles:

- Lifestyle Integration: Investment options that align with personal interests, such as sustainable investments or luxury goods.

- Goal-Oriented Planning: Financial strategies that are not just about growing wealth but also about achieving personal milestones, like retirement or philanthropy.

Challenges in Luxury FintechZoom

While the potential for luxury fintechzoom is vast, it’s not without its challenges. Understanding these hurdles can help both providers and clients navigate the landscape more effectively.

Regulatory Compliance

The financial industry is heavily regulated, and luxury fintech companies must adhere to strict compliance standards. This can create hurdles in:

- New Market Entry: Navigating different regulatory frameworks across countries can be complex and time-consuming.

- Maintaining Privacy: Balancing transparency with the need for client confidentiality.

Competition and Market Saturation

As the demand for luxury fintech solutions grows, so does competition. Companies must find ways to differentiate themselves:

- Innovative Offerings: Continuously improving technology and services to stay ahead of competitors.

- Building Trust: Establishing a reputation for reliability and integrity in a crowded market.

The Future of Luxury FintechZoom

Looking ahead, the potential for luxury fintechzoom is bright. As technology continues to evolve, so too will the solutions available for affluent clients.

Emerging Technologies

- Blockchain: Its potential for transparency and security will likely enhance trust in digital transactions.

- Artificial Intelligence: AI can provide deeper insights into market trends and personalize services even further.

Trends to Watch

- Sustainable Investing: A growing emphasis on social responsibility in investing will shape future offerings.

- Integration with Lifestyle Apps: The line between finance and everyday life will blur, with financial services embedded in lifestyle applications.

Conclusion

In conclusion, luxury fintechzoom is more than just a trend; it’s a transformative movement reshaping how wealthy individuals manage their finances. With tailored solutions, enhanced security, and unique investment opportunities, it represents the future of personal finance for HNWIs. As technology continues to advance, those involved in this sector must remain agile, innovative, and responsive to the needs of their clients.

Change block type or style

Move Paragraph block from position 51 up to position 50

Move Paragraph block from position 51 down to position 52

Change text alignment

Displays more block tools

Exploring the World of Luxury FintechZoom

In today’s fast-paced world, technology is reshaping the way we think about money. One exciting development in this realm is luxury fintechzoom, a term that encapsulates the integration of financial technology into the high-end lifestyle sector. This article aims to delve into the concept of luxury fintechzoom, its benefits, key players, and how it’s transforming personal finance and investments for the affluent.

What is Luxury FintechZoom?

Luxury fintechzoom represents the convergence of luxury living and advanced financial technology. It involves digital solutions that cater specifically to the needs and preferences of wealthy individuals, enhancing their financial management and investment experiences. This niche segment of fintech not only focuses on making transactions easier but also on providing a seamless and luxurious experience.

Characteristics of Luxury FintechZoom

- Tailored Solutions: Services are customized to meet the unique needs of high-net-worth individuals (HNWIs).

- Personalized Service: High-touch customer service is a hallmark, often including dedicated advisors or concierge services.

- Innovative Technology: The use of cutting-edge technology, such as artificial intelligence and blockchain, to enhance security and efficiency.

- Exclusive Access: Many luxury fintech services offer exclusive investment opportunities that are not available to the average investor.

The Evolution of Fintech and Luxury Markets

The financial technology industry has seen tremendous growth over the past decade. From mobile banking apps to investment platforms, fintech has made financial services more accessible to the masses. However, the luxury market requires a different approach.

Historical Context

- Early Innovations: The rise of online banking in the early 2000s began to pave the way for digital financial services.

- Wealth Management Revolution: Traditional wealth management firms started incorporating technology to enhance client experiences.

- Emergence of Luxury Fintech: In the late 2010s, the need for luxury-focused fintech solutions became apparent as HNWIs sought personalized services that matched their lifestyles.

Benefits of Luxury FintechZoom

The emergence of luxury fintechzoom has brought numerous advantages to affluent clients. Understanding these benefits can help individuals make informed decisions about their financial management.

Streamlined Financial Management

Luxury fintech services often offer integrated platforms where clients can manage all their financial assets in one place. This includes:

- Real-time Tracking: Monitor investments, expenses, and income from a single dashboard.

- Automated Alerts: Get notifications for important financial events, ensuring nothing goes unnoticed.

- Holistic View: Access to a comprehensive view of personal and investment portfolios.

Enhanced Security Features

Wealthy individuals are often targets for fraud and cyberattacks. Luxury fintech solutions prioritize security by offering:

- Advanced Encryption: Protect sensitive financial data from unauthorized access.

- Multi-Factor Authentication: Ensure that only authorized users can access financial accounts.

- Regular Security Audits: Frequent assessments to identify and rectify vulnerabilities.

Personalized Investment Opportunities

With luxury fintechzoom, clients gain access to unique investment avenues that cater to their interests and risk appetites:

- Exclusive Deals: Opportunities in luxury real estate, art investments, and private equity.

- Customized Portfolio Management: Investment strategies tailored to individual financial goals and market trends.

Key Players in Luxury FintechZoom

As the luxury fintech market grows, several companies stand out as leaders in providing innovative solutions tailored to HNWIs.

Notable Companies

- Wealthfront: Offers personalized investment management and financial planning tools designed for affluent clients.

- Robinhood Gold: A premium version of the popular trading app, providing advanced features and higher investing limits.

- Kavout: Uses machine learning to provide investment insights, appealing to tech-savvy investors in the luxury market.

Emerging Startups

- Aspiration: Focuses on socially responsible investing while providing traditional banking services.

- N26: A digital bank that emphasizes transparency and offers luxury services like travel insurance and premium accounts.

How Luxury FintechZoom is Changing Wealth Management

The rise of luxury fintechzoom is revolutionizing how wealth management is approached. Clients are no longer satisfied with traditional models and are seeking more innovative, tech-driven solutions.

The Shift Toward Technology

- Data-Driven Decisions: Wealth managers now use advanced analytics to guide investment strategies.

- Client Engagement: Digital platforms allow for greater interaction and transparency between advisors and clients.

- Global Access: Wealth management services are now available worldwide, breaking down geographical barriers.

The Role of Personalization

Personalization has become a key factor in wealth management. Clients want services that resonate with their unique values and lifestyles:

- Lifestyle Integration: Investment options that align with personal interests, such as sustainable investments or luxury goods.

- Goal-Oriented Planning: Financial strategies that are not just about growing wealth but also about achieving personal milestones, like retirement or philanthropy.

Challenges in Luxury FintechZoom

While the potential for luxury fintechzoom is vast, it’s not without its challenges. Understanding these hurdles can help both providers and clients navigate the landscape more effectively.

Regulatory Compliance

The financial industry is heavily regulated, and luxury fintech companies must adhere to strict compliance standards. This can create hurdles in:

- New Market Entry: Navigating different regulatory frameworks across countries can be complex and time-consuming.

- Maintaining Privacy: Balancing transparency with the need for client confidentiality.

Competition and Market Saturation

As the demand for luxury fintech solutions grows, so does competition. Companies must find ways to differentiate themselves:

- Innovative Offerings: Continuously improving technology and services to stay ahead of competitors.

- Building Trust: Establishing a reputation for reliability and integrity in a crowded market.

The Future of Luxury FintechZoom

Looking ahead, the potential for luxury fintechzoom is bright. As technology continues to evolve, so too will the solutions available for affluent clients.

Emerging Technologies

- Blockchain: Its potential for transparency and security will likely enhance trust in digital transactions.

- Artificial Intelligence: AI can provide deeper insights into market trends and personalize services even further.

Trends to Watch

- Sustainable Investing: A growing emphasis on social responsibility in investing will shape future offerings.

- Integration with Lifestyle Apps: The line between finance and everyday life will blur, with financial services embedded in lifestyle applications.

Conclusion

In conclusion, luxury fintechzoom is more than just a trend; it’s a transformative movement reshaping how wealthy individuals manage their finances. With tailored solutions, enhanced security, and unique investment opportunities, it represents the future of personal finance for HNWIs. As technology continues to advance, those involved in this sector must remain agile, innovative, and responsive to the needs of their clients.

By understanding the dynamics of luxury fintechzoom, individuals can harness its benefits, making informed decisions that align with their financial goals. As we look to the future, it’s clear that the intersection of luxury and technology will pave the way for a new era in wealth management, creating exciting opportunities for both providers and clients alike.

By understanding the dynamics of luxury fintechzoom, individuals can harness its benefits, making informed decisions that align with their financial goals. As we look to the future, it’s clear that the intersection of luxury and technology will pave the way for a new era in wealth management, creating exciting opportunities for both providers and clients alike.